VITA IS MADE POSSIBLE BY PURDUE FEDERAL CREDIT UNION

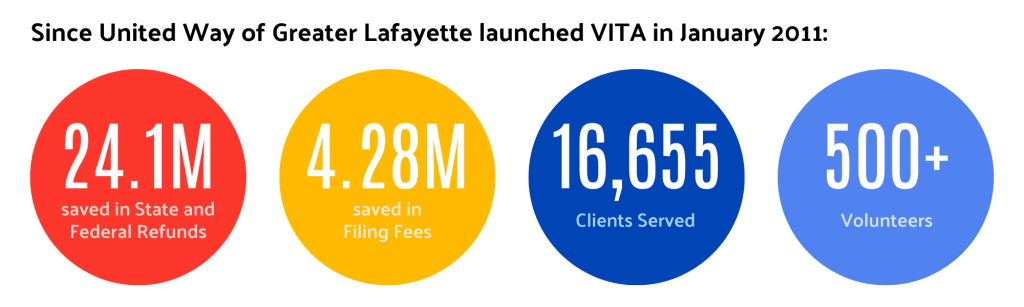

Thanks to their generous support, United Way’s VITA program is able to provide free, reliable tax preparation services to our community.

Volunteer Income Tax Assistance

United Way’s Volunteer Income Tax Assistance program completed operations in mid-April of this year. We are planning and preparing to open our doors in late January of 2026 for another spring of supporting local households in filing their taxes. If you need urgent support, send us an email at taxes@uwlafayette.org.

If you’d like to stay in the loop on updates related to our VITA program like when appointments become available click the button below and share with us some basic contact information.

WHAT IS VITA?

United Way of Greater Lafayette’s VITA Program provides free income tax assistance to eligible community members with the support of IRS-certified volunteers. We offer in-person, drop-off and virtual appointments at our Lafayette location.

WHO IS ELIGIBLE FOR VITA?

Individuals (and/or couples, if filing jointly) earning $84,000 or less are generally eligible for VITA services.

Individuals are NOT eligible (out of scope) for the VITA program if any of the following apply:

- You bought, sold, exchanged, or received virtual assets (such as Bitcoin or another cryptocurrency)

- You own or manage a rental property

- You are selling a home under contract

- You have farm income

- You operate a business with employees and/or physical inventory

- You were self-employed and had a loss in the applicable tax year

- You purchased an electric vehicle and want to claim the tax credit

- You are a nonresident alien for tax purposes

SAVE TIME FILING VIRTUALLY

If you have a simple return, you may be able to save yourself a trip to the office. Complete our online intake form, upload your documents, and United Way will text you within 5-7 business days when your return is ready for pickup.

How it works:

- Step Gather your documents – Take photos of Social Security cards, photo IDs, and any tax forms or letters.

- Step Complete the online intake form (Button below)– Upload your documents as prompted and delete sensitive photos from your device afterward.

- Step Save our number – Add (765) 237-9497 as “United Way VITA.” We’ll call or text with questions or when your return is ready.

- Step 4. Pick up your return – Once informed that your return is ready, come to our office Mon–Fri, 10 a.m.–5 p.m. Please bring your photo ID and Social Security card so we can verify your identity.

SCHEDULE AN APPOINTMENT

Individuals interested in the VITA program can use the button below to determine which appointment type is best and then schedule accordingly, or they can call or text us at (765) 237-9497. Our phone line can get busy, so we may not be able to answer right away. Please leave a message, and we’ll return your call as soon as possible.

Important items to note:

- Please arrive 10 minutes early to complete intake paperwork. You can save time by picking up the forms in advance or downloading them here. Please bring the completed forms (4) to your appointment. Intake forms include IRS Form 13614-C, IRS Form 15080, Cover Sheet, Indiana Intake Form.

- A team member will review your paperwork to clarify any questions/concerns before you meet with a volunteer tax preparer.

- For drop-off and virtual appointments, save (765) 237-9497 as “United Way VITA.” We will call or text when your return is ready for pickup or if we have any questions.

FILE YOUR OWN TAXES FOR FREE

This program, offered by United Way in partnership with the IRS VITA program, lets you file your return on your own or with help from trained volunteers. Over 1.3 million filers have saved $260 million in tax preparation costs — and you can too!

VOLUNTEER WITH VITA

VITA is more than tax preparation — it’s about access, dignity and opportunity for our community members in need. Every return you help prepare makes a real financial impact for individuals and families in our community. Service is the true reward!

Training Requirements

- Training/studying for the required IRS certifications can take 8-14 hours depending on experience level. This will vary from person to person.

- MEMORIZING THE MATERIAL IS NOT REQUIRED! The certifications and tax season are both open book. You just need to know how to use your resources to find answers.

- There are three required certifications for our VITA site:

- Volunteer Standards of Conduct

- Intake/Interview & Quality Review

- Advanced – (Basic is NOT required!)

Level of Commitment

- This filing season will run from January 22nd to April 10th

- February is the busiest month and will require the highest volume of volunteers. We will also need additional support during Purdue’s Spring Break.

- Uphold the United Way Volunteer Contract & IRS Volunteer Standards of Conduct

- We ask that each volunteer commit to a minimum of 12 volunteer hours. Please note this is NOT a requirement, just extremely helpful with planning.

- 1-hour in-person appointments with four stations operating at a time — 24 appointments per day + drop-offs/virtual returns as time allows

- 3-hour volunteer shifts.

- Morning: 10:00 AM–1:00 PM

- Lunch break: 1:00 PM-2:00 PM

- Afternoon: 2:00 PM–5:00 PM

- TBD evenings and Saturdays

INTERESTED IN LEARNING MORE OR HAVE QUESTIONS?

General questions and scheduling — Call or text us at (765) 237-9497

Volunteering — Contact Michelle Gorvie at mgorvie@uwlafayette.org